Ultimate Guide to Recognizing Corporate Volunteer Contracts and How They Profit Businesses

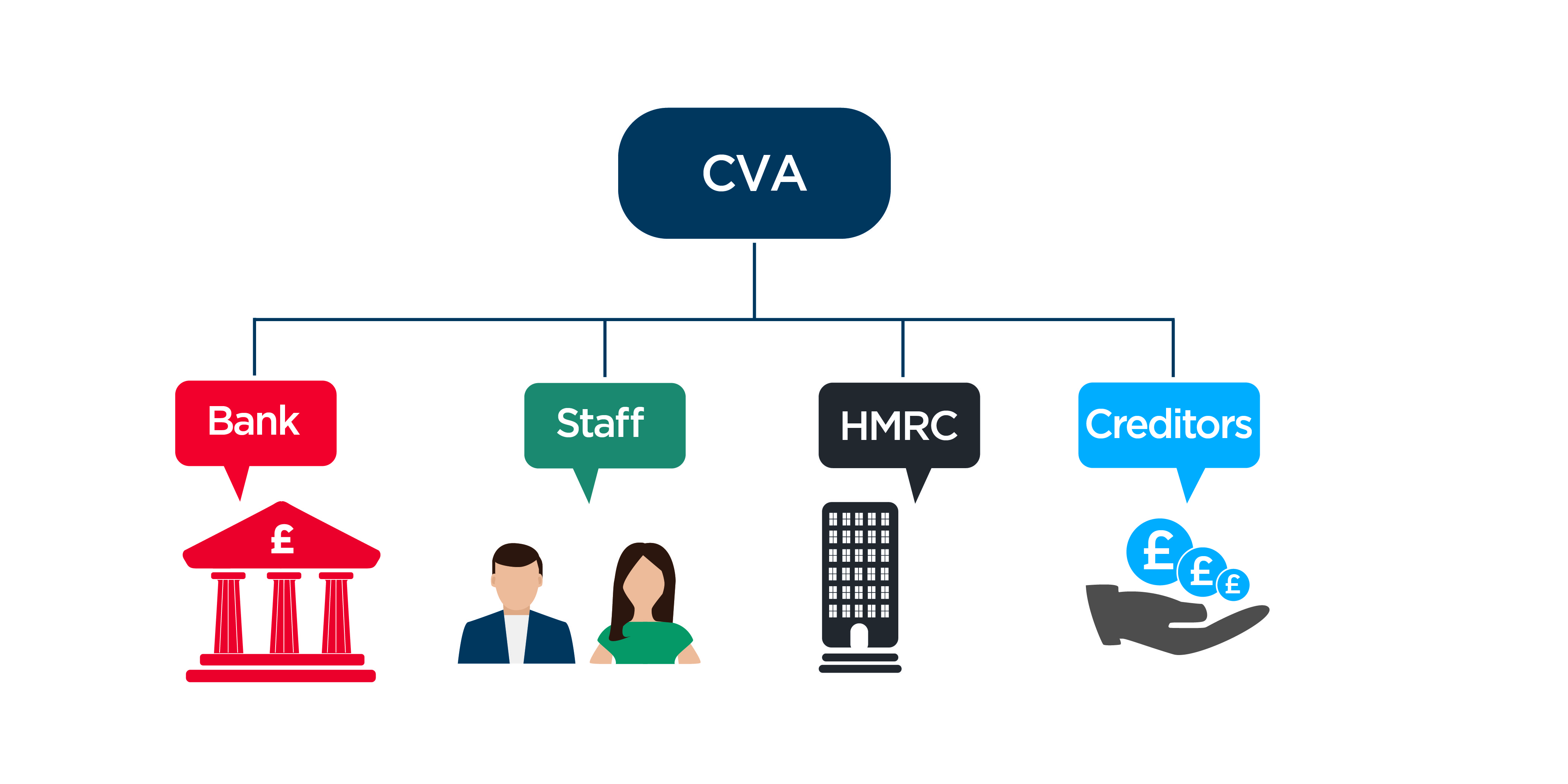

Company Voluntary Agreements (CVAs) have ended up being a critical device for businesses looking to navigate monetary difficulties and reorganize their procedures. As the organization landscape proceeds to advance, understanding the intricacies of CVAs and exactly how they can positively affect business is vital for educated decision-making.

Recognizing Company Volunteer Arrangements

In the world of company administration, a basic principle that plays an essential duty fit the connection in between stakeholders and business is the elaborate mechanism of Corporate Voluntary Arrangements. These arrangements are volunteer commitments made by firms to stick to specific standards, methods, or objectives beyond what is legally needed. By participating in Business Volunteer Agreements, business show their dedication to social duty, sustainability, and honest service practices.

One key aspect of Company Volunteer Contracts is that they are not lawfully binding, unlike regulative demands. Nonetheless, firms that willingly dedicate to these agreements are still anticipated to maintain their guarantees, as stopping working to do so can result in reputational damage and loss of stakeholder count on. These contracts usually cover locations such as environmental management, labor legal rights, diversity and inclusion, and neighborhood engagement.

Benefits of Business Voluntary Contracts

Relocating from an exploration of Corporate Volunteer Agreements' significance, we currently turn our focus to the concrete advantages these arrangements provide to companies and their stakeholders (cva meaning business). One of the main advantages of Business Voluntary Contracts is the opportunity for firms to restructure their financial debts in a much more convenient method.

Moreover, Business Voluntary Contracts can enhance the business's reputation and connections with stakeholders by demonstrating a commitment to resolving monetary obstacles responsibly. By proactively looking for solutions with volunteer agreements, services can showcase their commitment to keeping and fulfilling commitments trust within the market. These contracts can supply a degree of confidentiality, allowing business to work with financial problems without the public examination that might come with other restructuring options. In General, Business Volunteer Arrangements act as a strategic tool for companies to navigate financial obstacles while protecting their procedures and connections.

Process of Executing CVAs

Understanding the process of carrying out Company Voluntary Contracts is crucial for companies seeking to navigate monetary obstacles effectively and sustainably. The very first action in applying a CVA involves appointing an accredited bankruptcy expert that will work closely with the business to examine its economic scenario and stability. Throughout the implementation process, regular communication with lenders and persistent monetary administration are crucial to the effective implementation of the CVA and the business's ultimate monetary healing.

Secret Factors To Consider for Services

One more important factor to corporate voluntary agreement consider is the degree of transparency and interaction throughout the CVA procedure. Open and honest interaction with all stakeholders is important for building trust fund and making sure a smooth application of the arrangement. Services ought to also take into consideration seeking specialist recommendations from financial professionals or legal specialists to browse the complexities of the CVA procedure effectively.

In addition, companies require to evaluate the lasting implications of the CVA on their online reputation and future financing possibilities. While a CVA can provide instant alleviation, it is important to evaluate exactly how it might impact connections with creditors and financiers in the lengthy run. By thoroughly taking into consideration these key elements, organizations can make informed decisions pertaining to Corporate Voluntary Arrangements and establish themselves up for a successful monetary turn-around.

Success Stories of CVAs in Activity

Numerous organizations have actually effectively carried out Business Voluntary Agreements, showcasing the effectiveness of this financial restructuring tool in renewing their procedures. By getting in into a CVA, Company X was able to renegotiate lease agreements with landlords, lower expenses expenses, and restructure its financial obligation obligations.

In another circumstances, Business Y, a manufacturing company strained with tradition pension liabilities, made use of a CVA to rearrange its pension obligations and simplify its operations. Through the CVA procedure, Business Y achieved substantial expense savings, boosted its competition, and secured lasting sustainability.

These success stories highlight just how Corporate Volunteer Agreements can supply struggling services with a viable course towards monetary recuperation and operational turnaround. By proactively resolving financial obstacles and restructuring responsibilities, firms can emerge stronger, extra agile, and better placed for future growth.

Final Thought

Finally, Corporate Voluntary Contracts supply companies an organized strategy to dealing with monetary troubles and reorganizing debts. By executing CVAs, business can stay clear of insolvency, shield their assets, and preserve partnerships with lenders. The procedure of carrying out CVAs includes cautious planning, negotiation, and dedication to conference agreed-upon terms. Companies should consider the possible advantages and disadvantages of CVAs prior to making a decision to pursue this option. On the whole, CVAs have actually confirmed to be efficient in helping companies overcome monetary difficulties and accomplish long-term sustainability.

In the realm of corporate administration, an essential idea that plays a pivotal role in forming the connection between companies and stakeholders is the complex mechanism of Corporate Volunteer Contracts. corporate voluntary agreement. By entering right into Business Volunteer Contracts, companies show their commitment to social responsibility, sustainability, and moral company practices

Relocating from an exploration of Company Voluntary Agreements' relevance, we now transform our attention to the substantial advantages these arrangements use to companies and their stakeholders.Additionally, Corporate Volunteer Agreements can boost the company's online reputation and connections with stakeholders by showing a commitment to resolving monetary obstacles responsibly.Recognizing the process of carrying out Corporate Voluntary Arrangements is vital for firms seeking to browse economic challenges successfully and sustainably.